Realty Income (NYSE:O) has taken a preferred equity stake in gaming properties as part of its expanding investment focus. The company has also entered a major logistics partnership, adding new exposure beyond traditional retail real estate. These recent moves point to a broader approach to property types and geographies within its portfolio.

For investors tracking Realty Income at a share price of $65.66, these new deals arrive alongside a period of solid stock performance, with the shares up 2.8% over the past week and 25.7% over the past year. The company, known for its monthly dividends, is now tying its brand more closely to sectors like gaming and logistics rather than relying only on retail tenants.

The shift into gaming properties and logistics may influence how you think about NYSE:O in terms of growth potential, income stability, and risk mix across different property types. As these investments mature, the balance between long-established retail assets and newer sectors could play a bigger role in how the stock is viewed in income focused portfolios.

Stay updated on the most important news stories for Realty Income by adding it to your watchlist or portfolio. Alternatively, explore our Community to discover new perspectives on Realty Income.

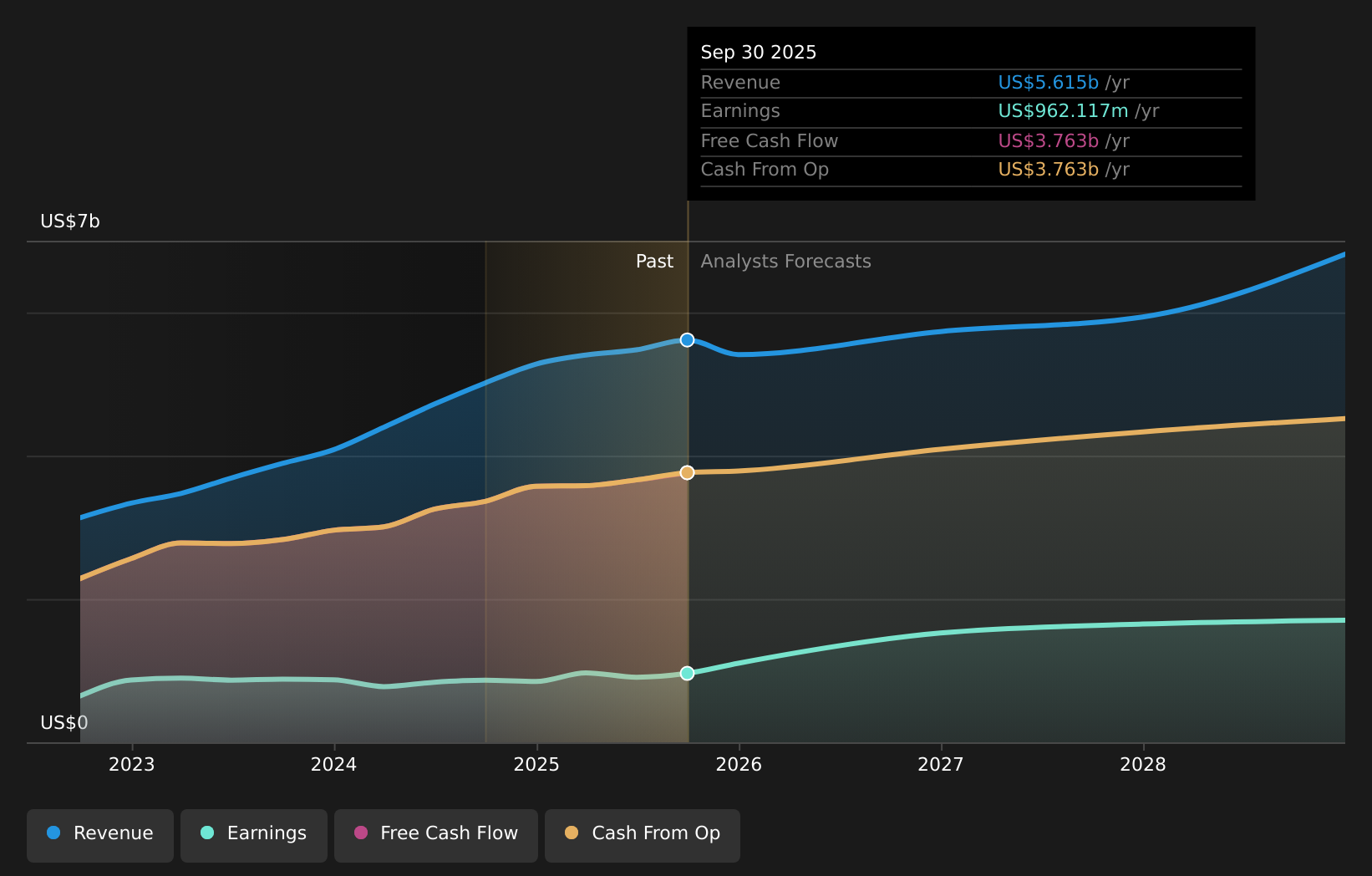

NYSE:O Earnings & Revenue Growth as at Feb 2026

NYSE:O Earnings & Revenue Growth as at Feb 2026

4 things going right for Realty Income that this headline doesn’t cover.

Quick Assessment ⚖️ Price vs Analyst Target: Realty Income trades at $65.66, roughly 2.1% above the US$64.31 analyst price target midpoint. ✅ Simply Wall St Valuation: Simply Wall St’s model has Realty Income trading about 34.6% below its estimated fair value, suggesting meaningful upside to that estimate. ✅ Recent Momentum: The stock has returned about 6.9% over the last 30 days, which supports the recent move into gaming and logistics exposure.

There is only one way to know the right time to buy, sell or hold Realty Income. Head to Simply Wall St’s

company report for the latest analysis of Realty Income’s Fair Value.

Key Considerations 📊 The new gaming preferred equity and logistics partnership broaden Realty Income’s tenant and asset mix, which may change how you think about its income profile. 📊 Keep an eye on how these deals affect rental income, occupancy, and the P/E of 62.8 compared with the Retail REITs industry average of 28.0. ⚠️ One flagged risk is that interest payments are not well covered by earnings, which matters if these investments are funded with additional debt. Dig Deeper

For the full picture including more risks and rewards, check out the

complete Realty Income analysis. Alternatively, you can visit the

community page for Realty Income to see how other investors believe this latest news will impact the company’s narrative.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Explore Now for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com